ad valorem tax calculator florida

An ad valorem tax is a tax that is based on the assessed value of a property product or service. This calculator can estimate the tax due when you buy a vehicle.

Property Tax Calculator Casaplorer

Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax.

. 36 - Lake Park. A yes vote supports continuing the levying of an ad valorem tax at a rate of 1 per 1000 of assessed property value for four years 2023-2027 to pay school teachers and fund school programs. The most common ad valorem taxes are property taxes levied on real estate.

Tax Estimation Calculator. Common examples include water and sewer waste collection and fire or ambulance. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption.

What is an example of an ad valorem tax. 34 - Lake Clarke Shores. This estimator calculates the estimated.

The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Duval County. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect.

Non-ad valorem assessments are often used as service charges. Fidelity National Financial - Florida Agency. Florida Property Tax Rates.

Get the benefit of tax research and calculation experts with Avalara AvaTax software. Overview of Florida Taxes. Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect to business improvements such as a new building building expansion or new equipment purchased in connection with.

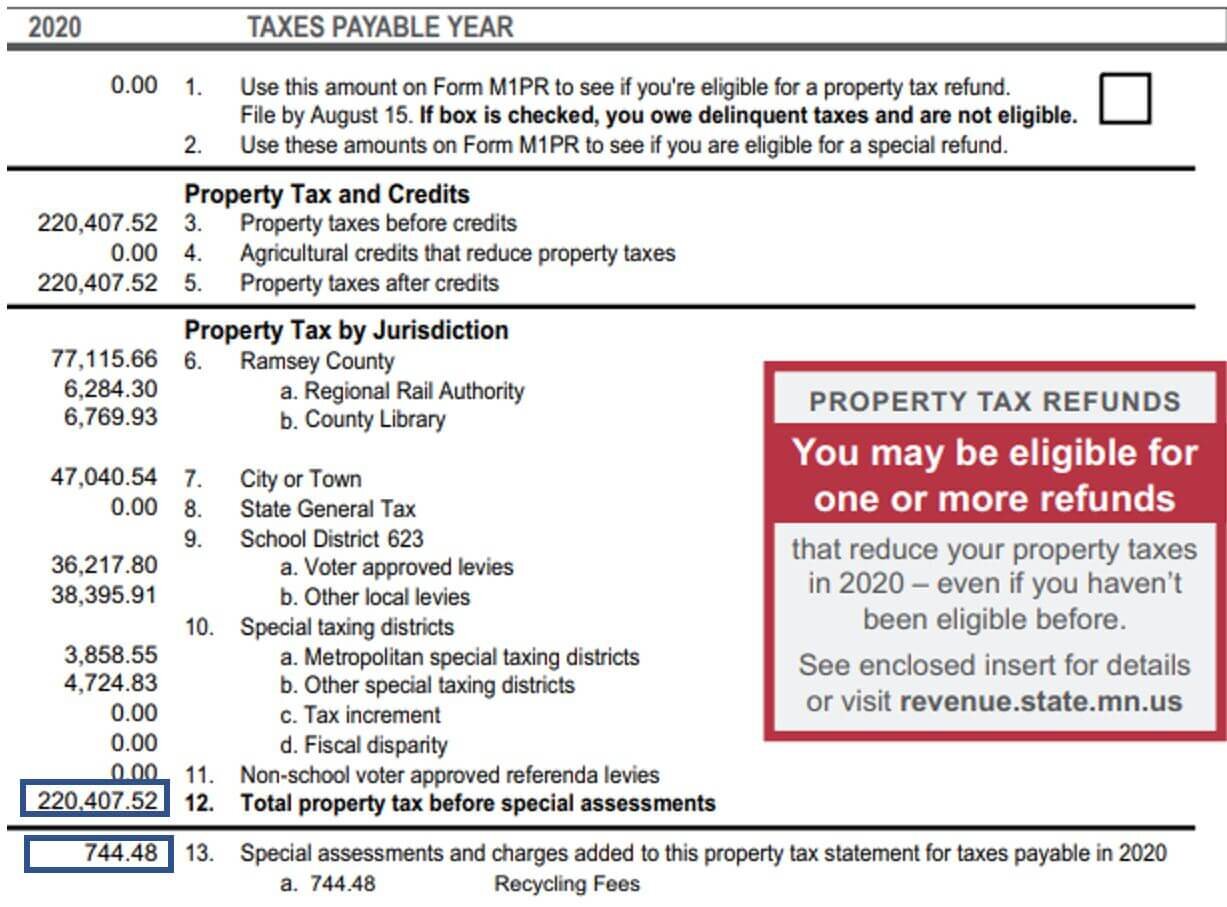

Past taxes are not a reliable projection of future taxes. You may also be part of a special district or assessment boundary that has different taxes than a nearby area. In Florida property taxes and real estate taxes are also known as ad valorem taxes.

Ad valorem means based on value. Santa Rosa County property taxes provide the fund local governments to provide. Some counties use only or nearly only valorem taxes.

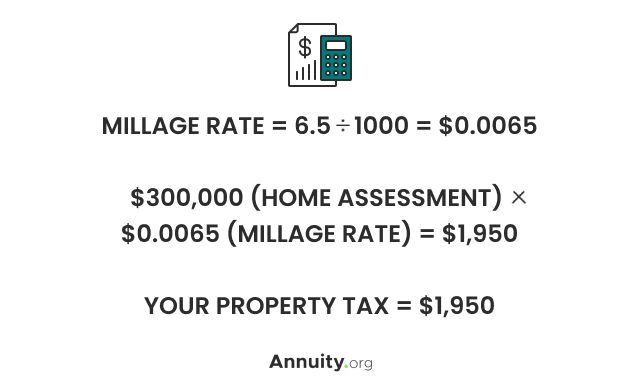

The estimated tax amount using this calculator is based upon the average Millage Rate of 200131 mills or 200131 and not the millage rate for a specific property. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property.

An ad valorem tax is based on the assessed value of an item such as real estate or personal property. 72 - Village of Royal Palm Beach. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those.

New residents to Georgia pay TAVT at a rate of 3 New Georgia Law effective July 1 2019. Ad Valorem Tax. Florida property taxes vary by county.

Estimating Ad Valorem Property Taxes. The most common ad valorem tax examples include property taxes on real estate sales tax on consumer goods and VAT on the value added to a final product or service. Overview of Florida Taxes.

See the online functions available at the Property Appraisers Office. The Latin phrase ad valorem means according to value. A number of different authorities including counties municipalities.

Florida has no state income tax which makes it a popular state for retirees and tax-averse workers. 70 - Village of Palm Springs. The maximum portability benefit that can be transferred is 500000.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. The tax roll describes each non-ad valorem assessment included on the property tax notice. On January 29 2008 Florida voters approved an additional 25000 homestead exemption to be applied to the value between 50000 and 75000.

Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. This tax estimation tool is provided to assist any potential home or business owner with an estimate of the ad valorem property taxes on a new purchase for properties within the municipalities and unincorporated areas of Lake County Florida. 32 - Jupiter Inlet Colony.

Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. If youre moving to Florida from a state that levies an income tax youll get a pleasant surprise when you see your first paycheck.

The Orange County Public Schools Florida Ad Valorem Tax Measure is on the ballot as a referral in Orange County Public Schools on August 23 2022. Therefore you must add the school taxes back in to the Gross Tax amount approximately 20000. Copies of the non-ad valorem tax roll and summary report are due December 15.

The results displayed are the estimated yearly taxes for the property using the last. The most common ad valorem taxes are property taxes levied on real estate. Florida Property Tax Calculator.

So all ad valorem taxes are based on the assessed value of the item being taxed. This estimator assumes that the application for the new homestead is made within 2 years of January 1st of the year the original homestead was abandoned. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

What is ad valorem tax exemption Florida. Choose a tax districtcity from the drop down box enter a taxable value in the space provided then press the Estimate Taxes button. On January 29 2008 Florida voters approved an additional 25000 homestead exemption to be applied to the value between 50000 and 75000.

If the vehicle is currently in the TAVT system the family member can pay a reduced TAVT rate of 5 of the fair market value of the vehicle. Taxes usually increase along with the assessments subject to certain exemptions. If you would like to calculate the estimated taxes on a specific property use the tax estimator on the.

38 - Lake Worth Beach. Tax savings due to the second 25000 homestead exemption exclude the school taxes. The greater the value the higher the assessment.

This tax estimator is based on the average millage rate of all Broward municipalities. This tax is based on the value of the vehicle. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value.

Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes. Additionally no Florida cities charge a local income tax. 74 - West Palm Beach.

Property taxes in Florida are implemented in millage rates.

A Guide To Underwriting Multifamily Property Tax Tactica Real Estate Solutions

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Real Estate Property Tax Constitutional Tax Collector

Tax Implications Of Canadian Investment In A Florida Rental Property

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Calculate Fl Sales Tax On Rent

Florida Income Tax Calculator Smartasset

What Is A Homestead Exemption And How Does It Work Lendingtree

Property Taxes Expected To Spike For New Homeowners

Car Tax By State Usa Manual Car Sales Tax Calculator

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Tax Implications Of Canadian Investment In A Florida Rental Property

Florida Property Tax H R Block

Estimating Florida Property Taxes For Canadians Bluehome Property Management

Millage Rates Walton County Property Appraiser